In Peru, the shampoo industry comprises many brands that compete to increase their market share, but the principal companies, Procter & Gamble, Unilever, and L’Oreal, stand out. Furthermore, in the last five years, new brands and product collections dedicated to hair care have entered the Peruvian market and have offered new value propositions to their products. (El Comercio, 2014; Biotop Professional, 2018; Gestión, 2015). As a result, in the face of the growth of the shampoo industry and the greater competitive environment, the companies from this sector must analyze and understand the behavior of the Peruvian consumer in his shopping process for hair care products.

This study aimed to analyze the shopper’s behavior in the buying process at the point of sale for the hair care category. In addition, the specific objectives were to analyze the visual attention in 1) the gondolas, 2) the packaging, 3) the prices, and 4) the advertising material of the shampoos.

PROCEDURE

A group of women between 18 and 45 were recruited in the same supermarket. They were given a shopping context, including shampoo, soap, and deodorant for personal use. The context described the occasion and the necessity. They were reminded they didn’t have a time limit to choose the products and that after the selection they went to the cashier.

The study used eye-tracking technology to register the ocular movements in response to certain stimuli (Gonzáles & Velásquez, 2012). This method examines the effect of the consumer’s attention on their information processing, preference, and election behavior and evaluation (Van Loo, Grebitus, Nayga, Verbeke, & Roosen, 2018). In addition, Meyerding and Merz (2018) recommend eye tracking to study the consumer’s attention because the selection process and the consumer’s observation can be evaluated.

With the information registered, the following questions were answered:

- What relationship exists between visual attention and purchase intention at the point of sale?

- How much visual attention time does the shopper give to the Hair Care category?

- Is my brand being seen by the shoppers at the point of sale?

- How is the interaction with the packaging?

- How much visual attention does the shopper spend reading the information in the packaging?

- Are the shoppers of other brands seeing my product?

- Which other brands are the shoppers of my brand looking at?

- Is the price relevant for the category?

- Is the advertising material relevant to generate purchase intention at the point of sale?

FINDINGS

1. Shopper behavior while choosing a brand at the supermarket

- The shopper makes a fast visual scan.

The brands have between 0.5 and 3 seconds to grab the attention throughout the gondola.

- The entrance to the gondola is relevant—the place where the shoppers enter impacts the first seconds of visibility, given that they don’t necessarily go to the end of the gondola.

- Then, the shopper watches and buys – Brands have between 7 and 10 seconds to show their portfolio and the characteristics of the products.

2. Which zones of the gondola are the most visible?

The first row is the most effective—the impact of the second and third rows can depend on the packaging layout used.

- How does the shopper interact with the brand’s packaging?

The design of the packaging generates different behaviors. – In packaging with less information, time is spent mainly on the logo and variety without needing to read a greater description.

The time dedicated to understanding the information can allow jumping from one packaging to another with greater speed, allowing comparisons between more versions.

4. Price, product, promotional material

- Hair-care category in which price matters.

85% of shoppers looked at the price and spent 27% of the visual attention time.

38% of shoppers looked at promotional material on the gondola, which took up 3% of their visual attention time.

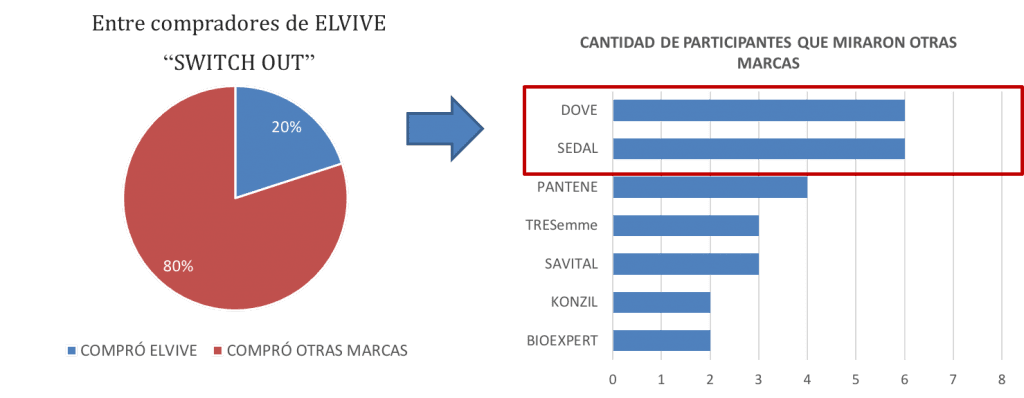

5. Brands that share visual attention

- Protecting Switch-out

- How many people who bought ELVIVE looked at the leading competing brands?

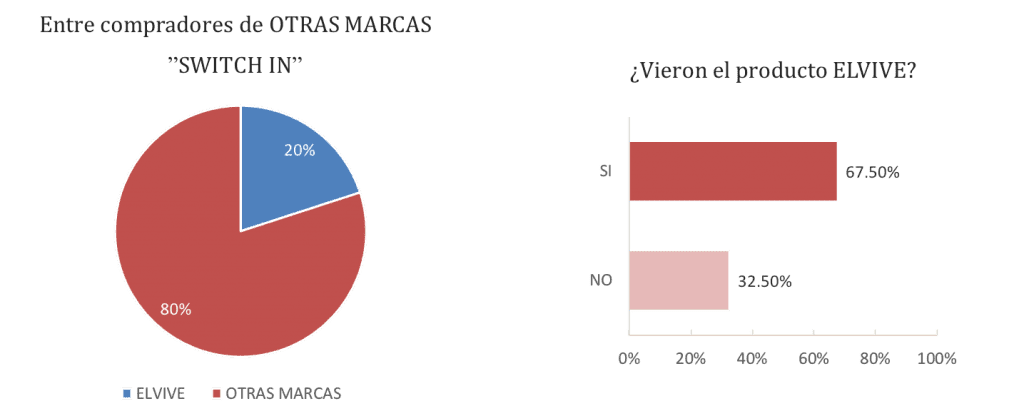

- Capture Switch-in

- Capture shoppers of the other brands that saw the product ELVIVE in the gondola.

- On average, 1 of 3 people didn’t see the product ELVIVE in the gondola.

6. Relationship between visibility and purchase intention

Source: Neurometrics

- The greater the consumer’s visual attention to a specific shampoo brand, the greater the purchase intention. However, some atypical cases, like Sedal and Konzil, captured visual attention but didn’t convince the shoppers to purchase.

- The greater the consumer’s visual attention to the price of a shampoo brand, the greater their purchase intention.

“85% of the shoppers looked at the price and spent 27% of the total visual attention time in the gondola.

- The brands had between 0.5 and 3 seconds to grab the shopper’s initial attention throughout the gondola, and the shoppers only sometimes walked through the aisle completely.

- The brands have less than 10 seconds to show the portfolio and the relevant characteristics through the packaging.

- Of the participants who didn’t choose a specific brand, nearly a third didn’t see that brand at the point of sale, even if it was exhibited.

RECOMMENDATIONS

1.Shopper’s behavior in the gondola.

- The location is essential to generate visibility in the first initial path, which lasts between 0.5 and 3 seconds.

- If we are on one edge of the gondola, it is essential to know which extreme has a greater circulation of people.

2. Zones with greater visibility in the gondola

- Place the franchise you want to promote the most in the top 1st row.

- Test different product layouts to optimize the visual attention time of the 2nd and 3rd rows.

3. Packaging Interaction

- Complex packaging makes it difficult to identify the franchise, considering the short time a shopper spends evaluating and comparing on the shelf (between 7 and 10 seconds)

Having biometric reports within the store that complement customer understanding through different sources of information allows new angles to be added to marketing decisions to improve effectiveness.

It was presented at Talkin 2019, SIUMER 2019, ESOMAR Brazil 2019, and the Cosmetics and Hygiene Guild of the Lima Chamber of Commerce.